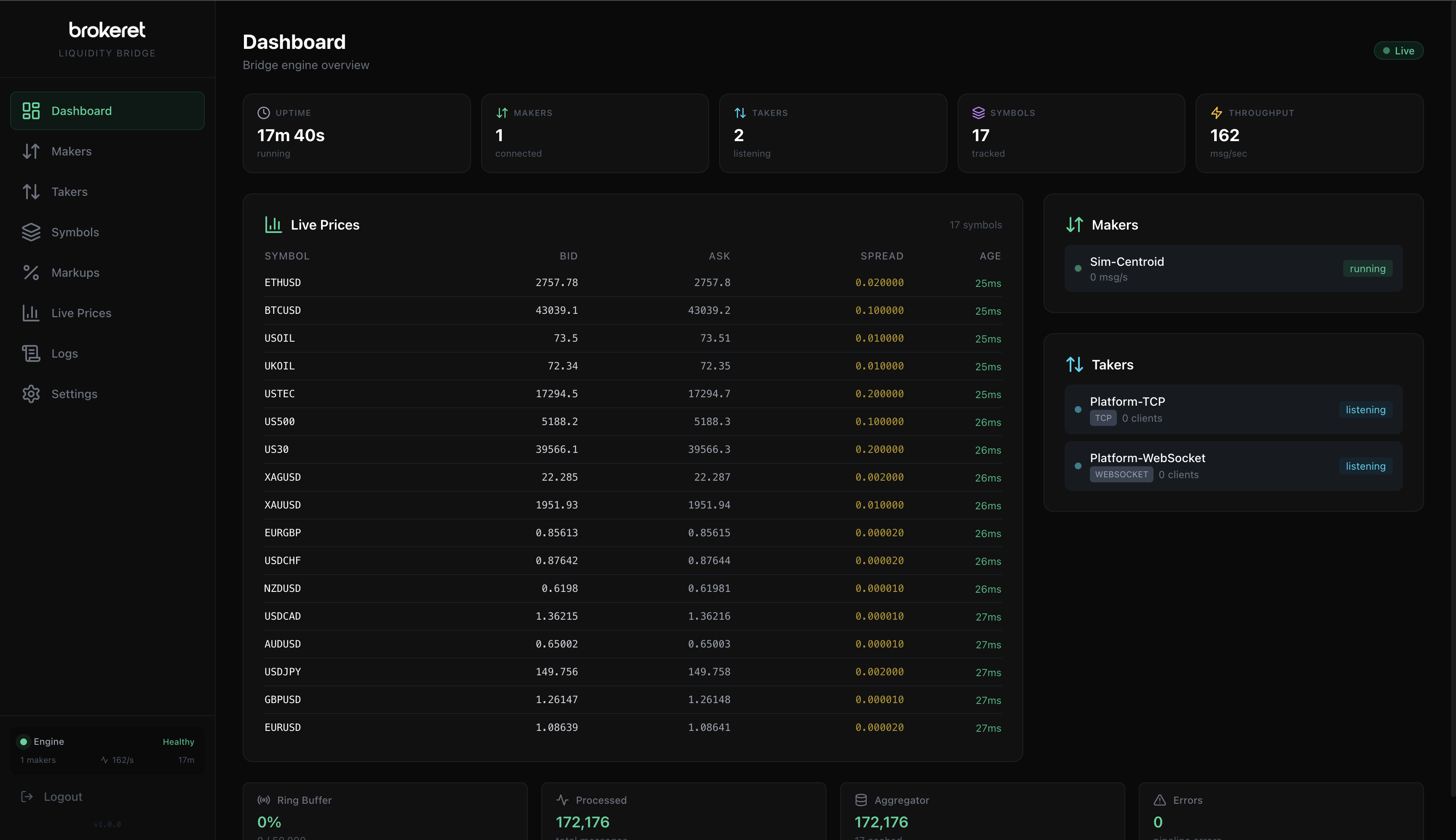

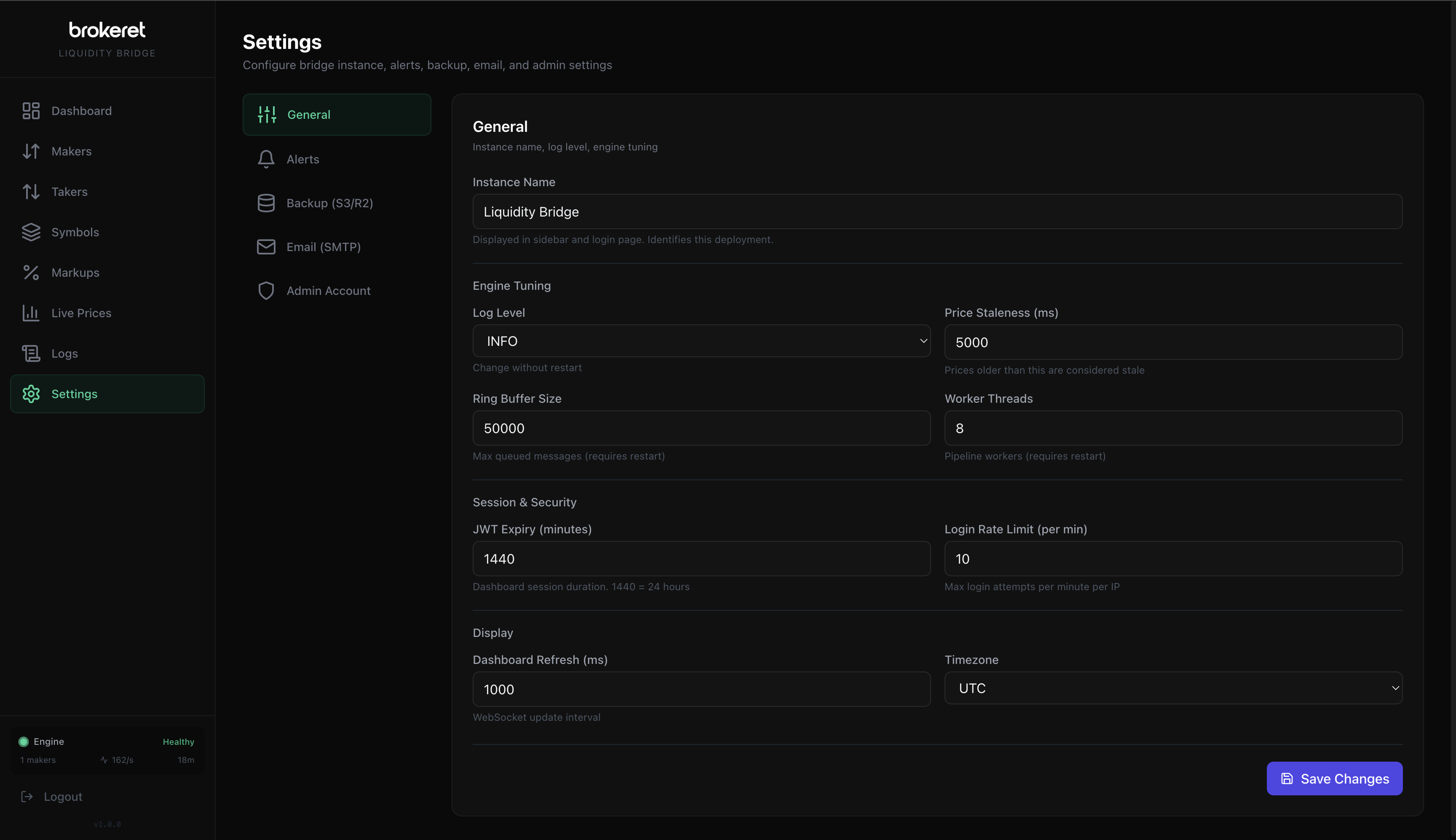

LiquidityBridge

Multi-LP Aggregation Engine

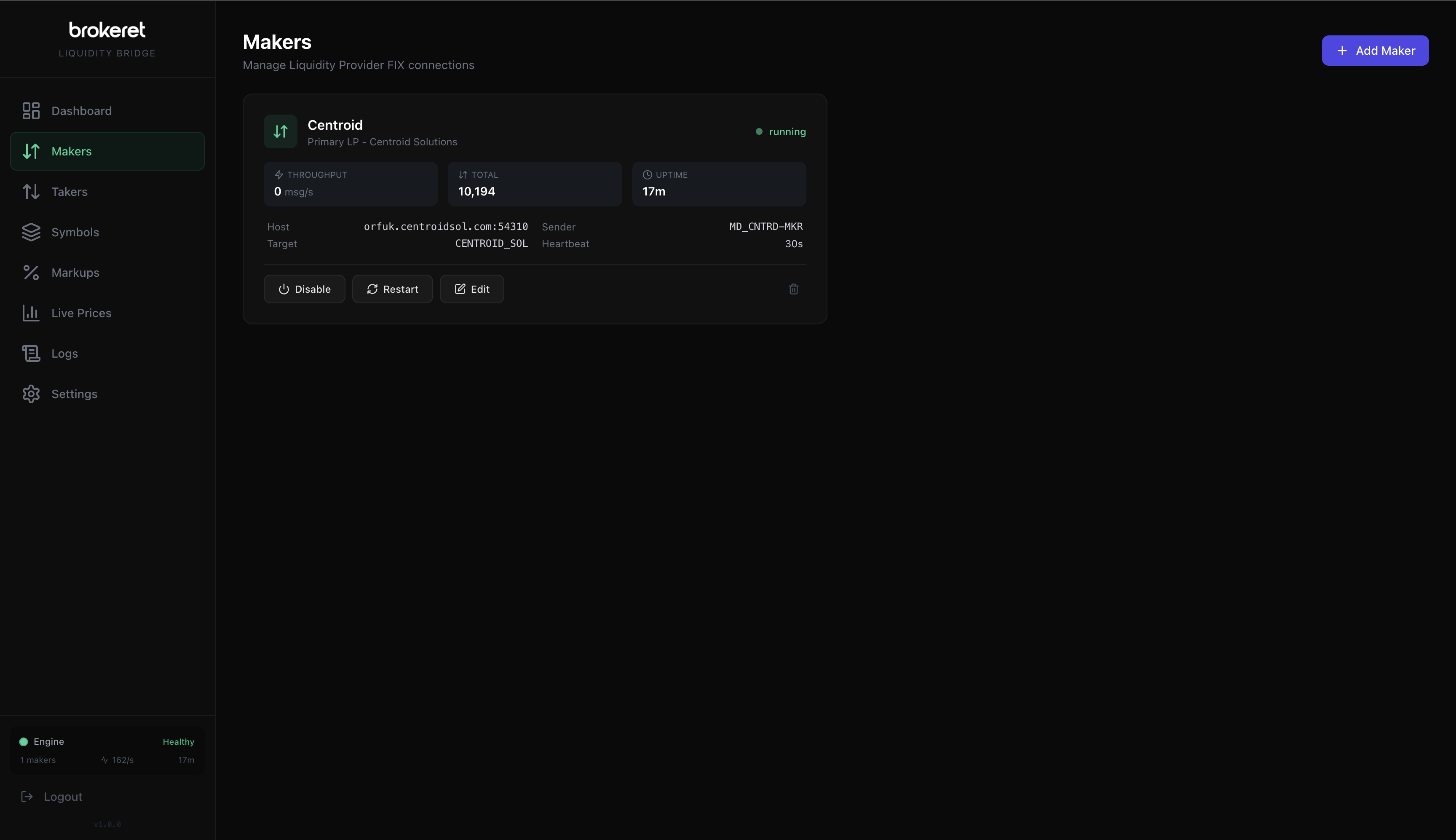

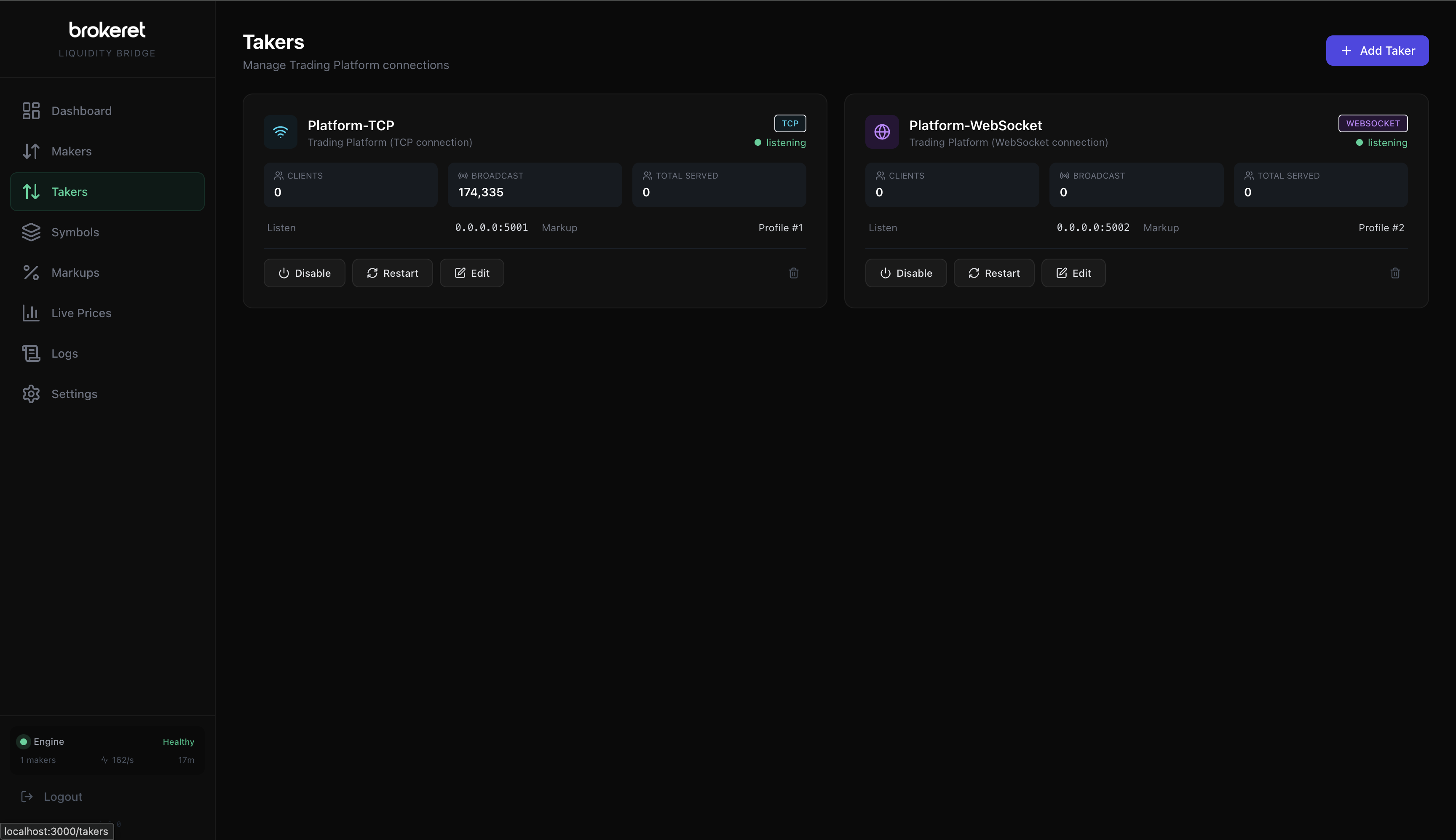

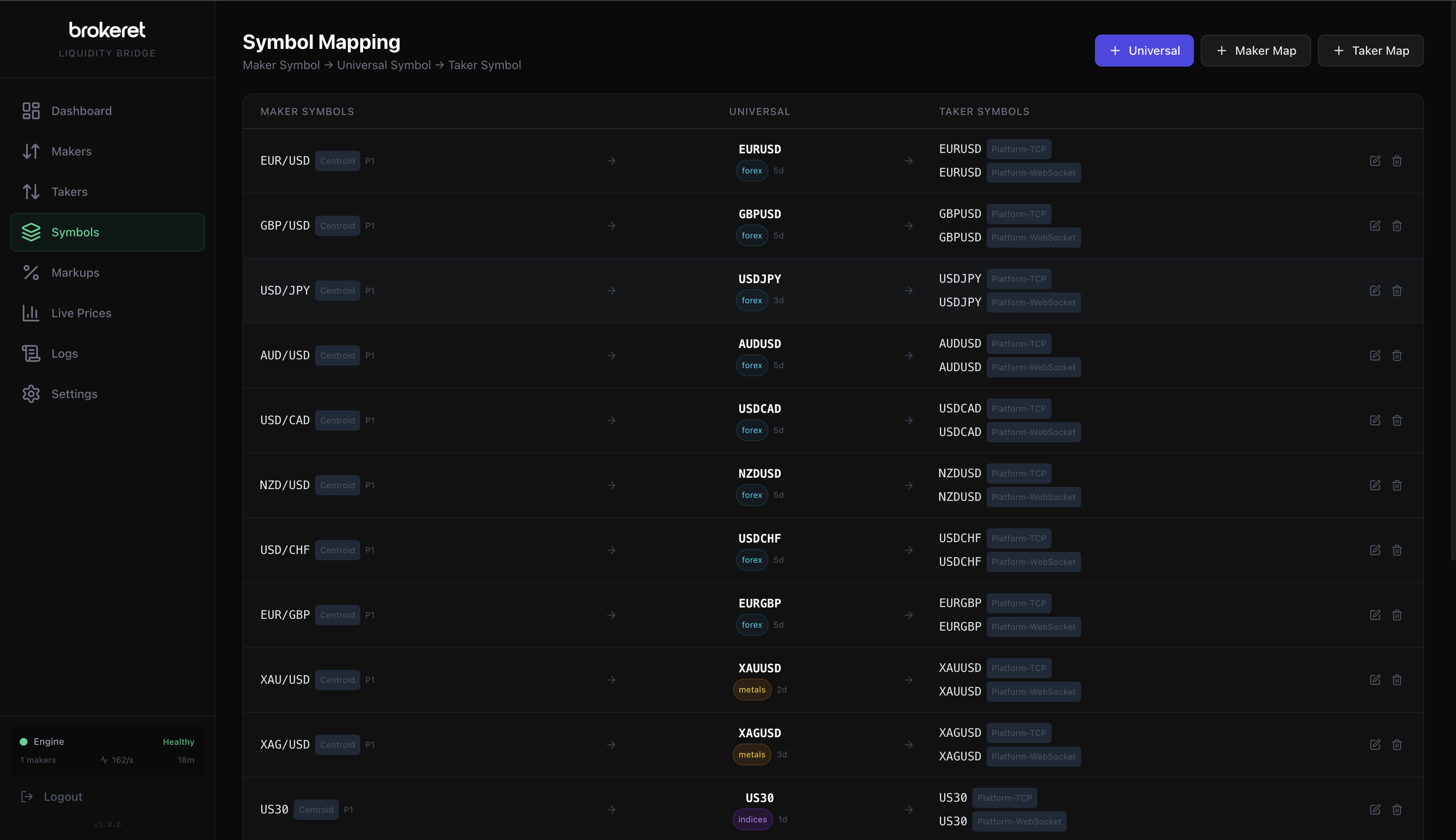

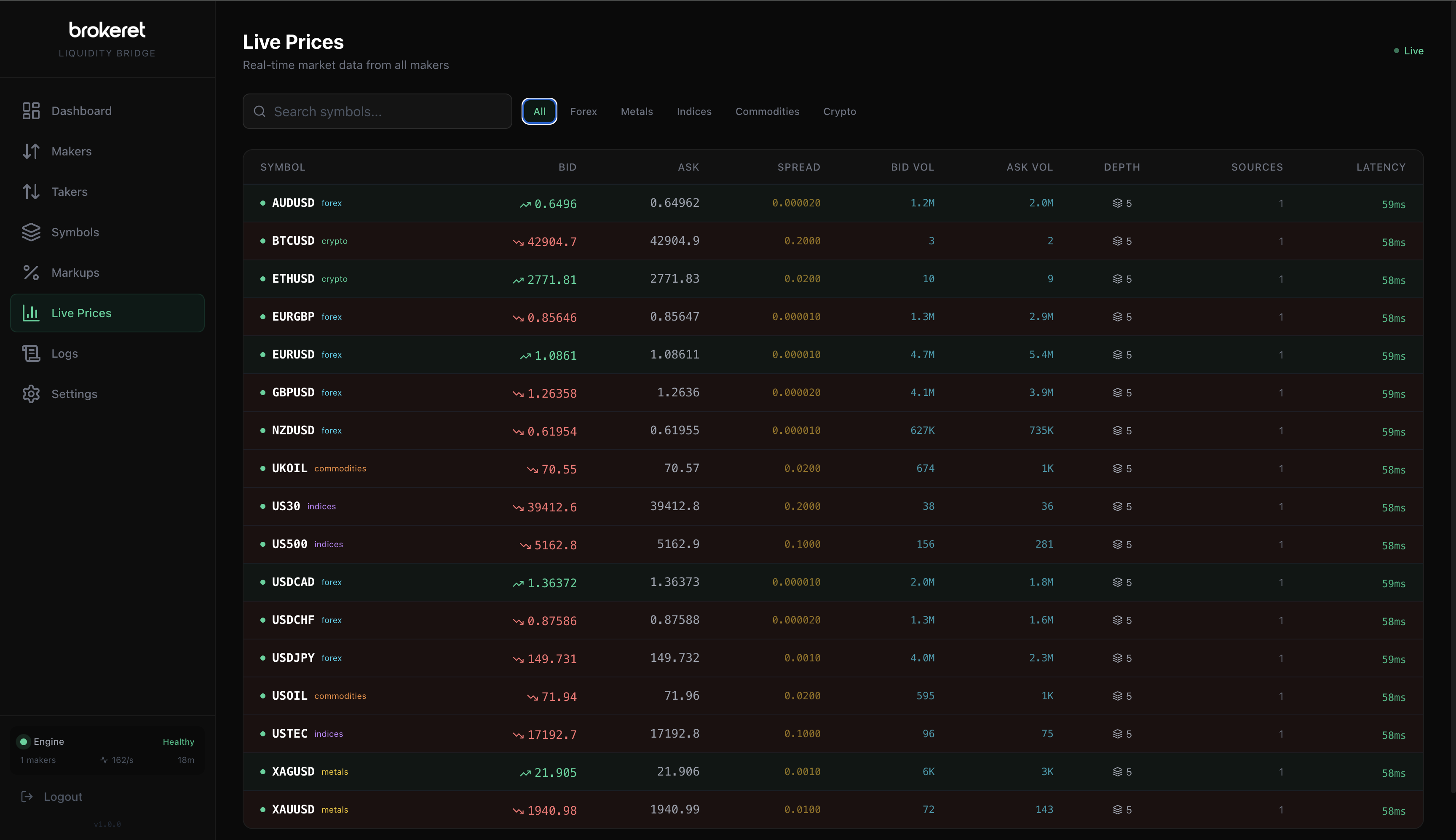

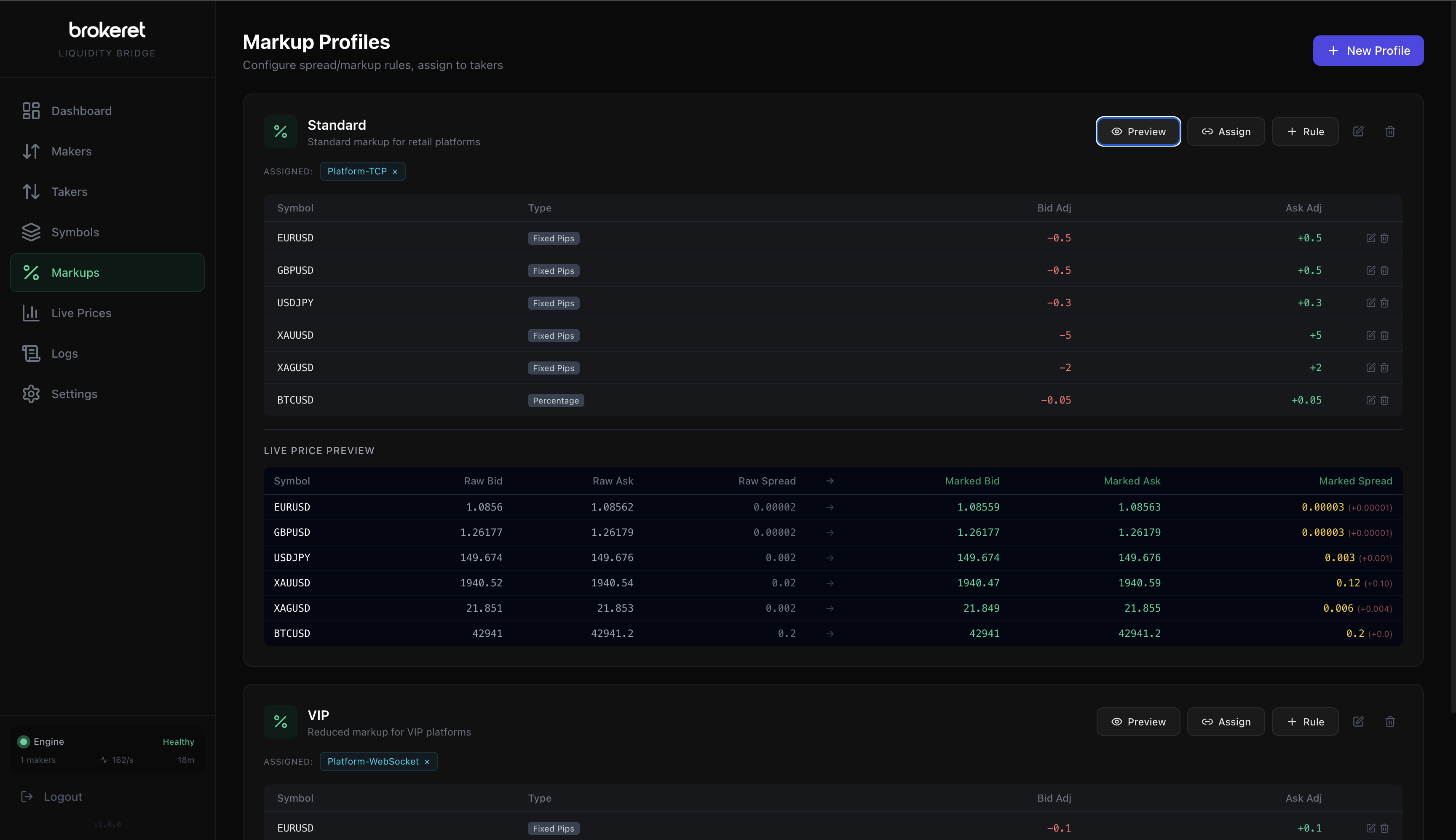

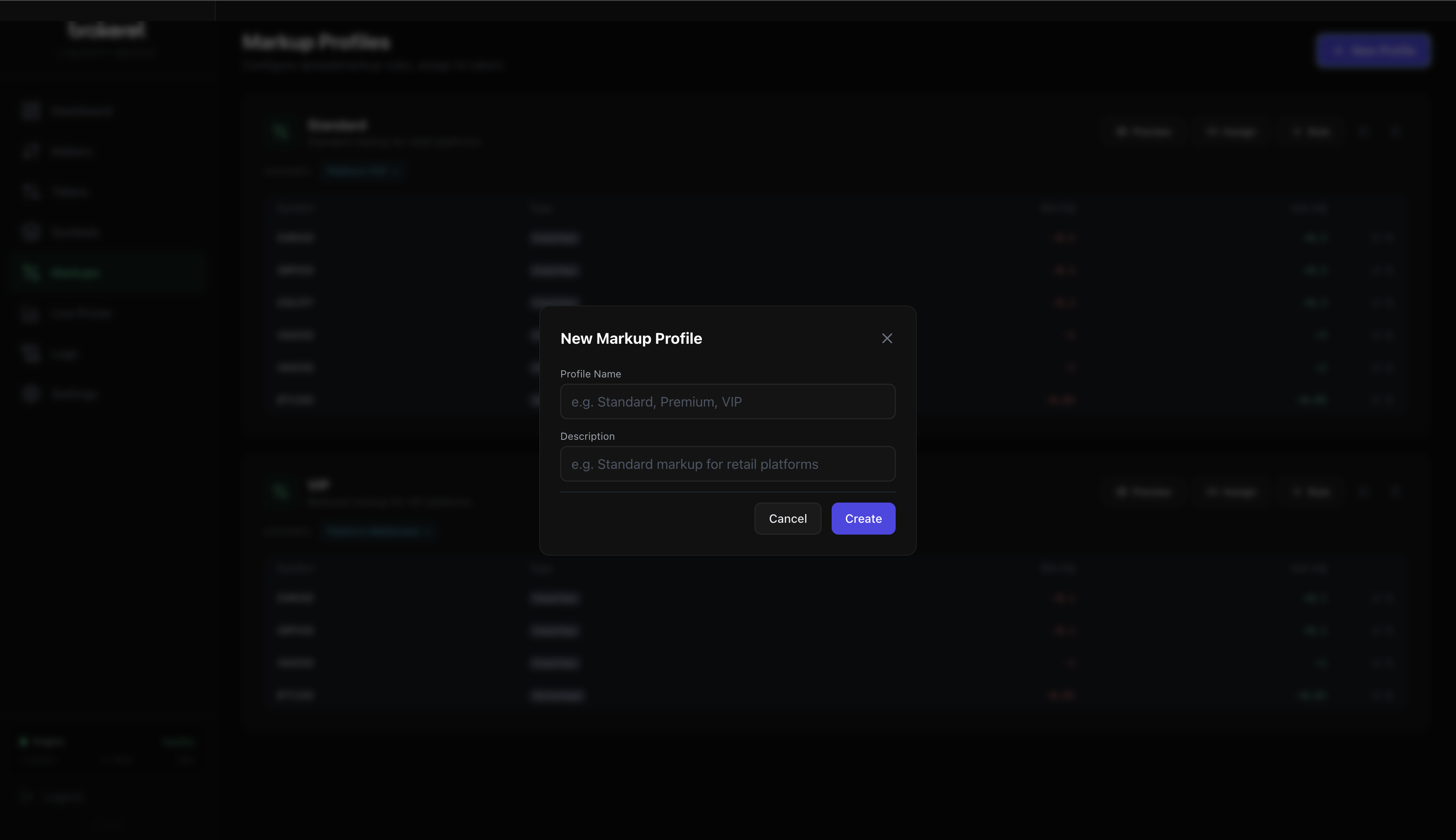

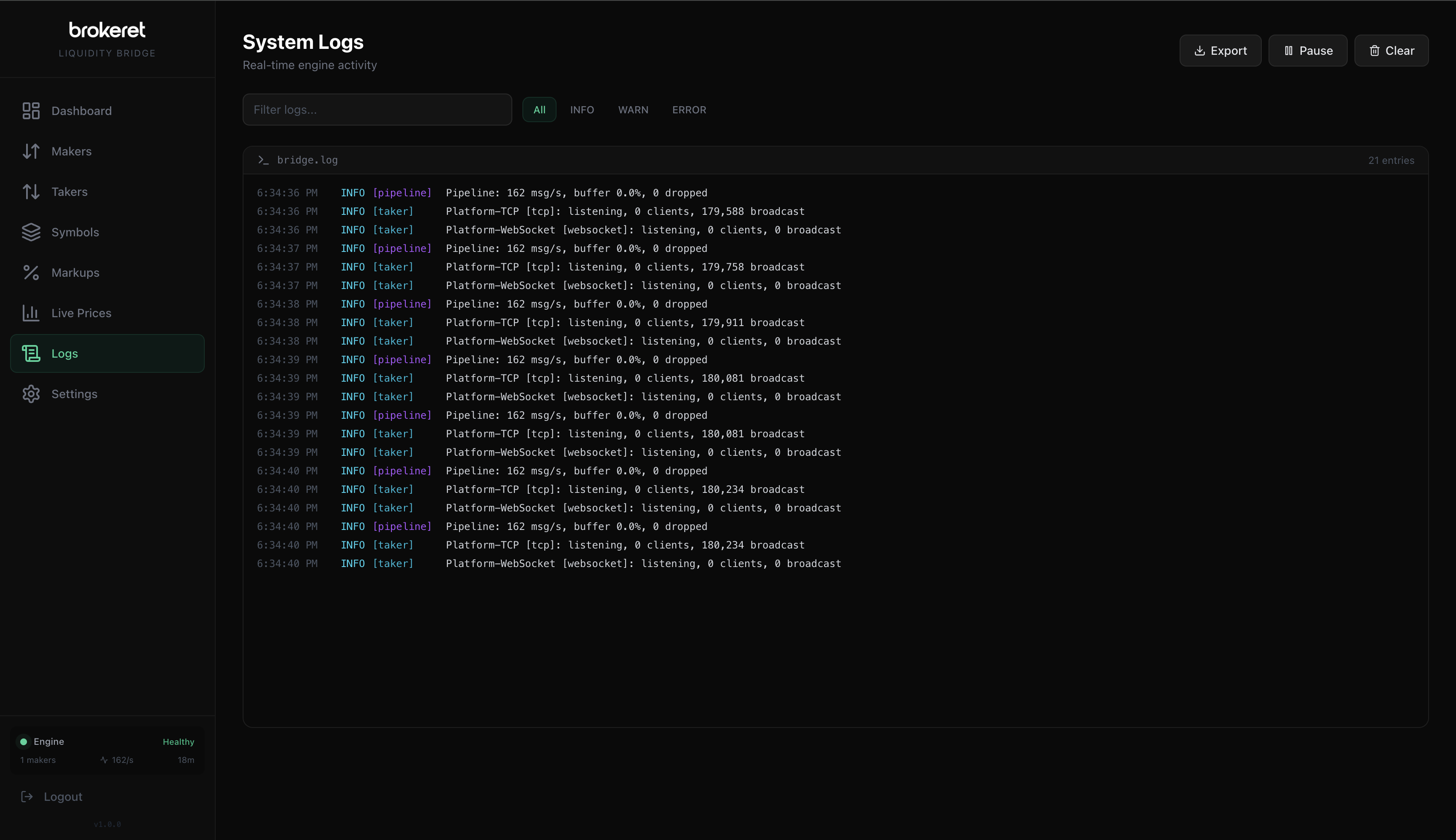

The middleware between your Liquidity Providers and Trading Platforms. Connect multiple LPs via FIX API, aggregate prices, map symbols, apply markups, and distribute to platforms via TCP, WebSocket, or FIX — all from one engine.